Latest Federal Tax Plan Bites Home and Second Home Owners

/From our friends at Candy's Dirt by Jon Anderson

Here’s the net-net of the proposed Republican plan to “lower” our taxes. Mortgage interest deductions would be capped at mortgages $500,000 or less (half the current $1 million) for primary residences. Mortgage interest deductions for second homes would simply vanish. You may be thinking this doesn’t sound bad and you may be mostly right. While I suspect the $500,000-plus market is relatively smaller than the sub-$500,000 market, the rub may be with the second home deduction. After all, how many soon-to-be retirees have a $400,000 primary residence and a $250,000 second home?

Many have second properties as future retirement homes, vacation homes, and/or rental properties (often keeping future retirement homes warm). The zero is a hit for those people and likely passed on to tenants renting those properties. Let’s be clear, the IRS allows mortgage interest to be deducted from two properties, not true property management companies.

The solution for second property owners will be to fold their second home mortgage into their primary mortgage if there’s enough equity. Literally putting all your eggs in one basket.

The second prong of this tax plan reduces property tax deductions to $10,000. Again, primary home only. In Dallas, homestead tax rates are about $2,300 per $100,000 of a home’s assessed value. meaning that any home valued above $435,000, will lose deductions. This cutoff is queasily less than the $500,000 mortgage tax cutoff.

Let’s Review

At $435,000 your property tax deduction runs out. At $500,000 your mortgage interest deduction runs out. All second property deductions are gone. Now I’m not too worried about the wealthy, but there is a sweet sour spot that’s a lot lower than you might have expected where you’re in the red.

The second home component has the potential to do some damage. For those who can’t combine their two mortgages into their primary mortgage, there’s money lost. I figure my tiny, two-property empire will cost me $8,000 in deductions on mortgage interest and another $1,800 in property taxes. All totted up, that’s about $2,500 in added, hard-dollar taxes, and I’m nowhere near the proposed caps.

But how many snowbirds maintain two homes? How many, like me, have a tiny (900 square-foot) getaway for our golden years? How many have a second rental property to prop up their income? None of these three examples are necessarily torn from the pages of Lifestyles of the Rich and Famous.

You’re right, I didn’t mention that the standard deduction would also double to $12,000 for we singles and $24,000 for you married folks. But that’s the thing, standard deductions are only good if you’ve got nothing else to declare. Start tossing some coins in the fountain and making a few charitable contributions, and you see the standard deduction in the rearview mirror. Especially if you’re single.

How’s This Gonna Work?

The mortgage interest deduction will likely get the lesser play as powerful old folks with plenty of equity and relatively small mortgages won’t feel as big of a pinch. They’ll be complaining about the property tax deduction limits, especially in states with high real estate costs (the coasts) and/or high property tax rates (Texas). Every single-family home in Park Cities and Preston Hollow would get whacked by this, but so would a lot of Oak Lawn, Oak Cliff, Uptown, Knox-Henderson, M Streets, etc.

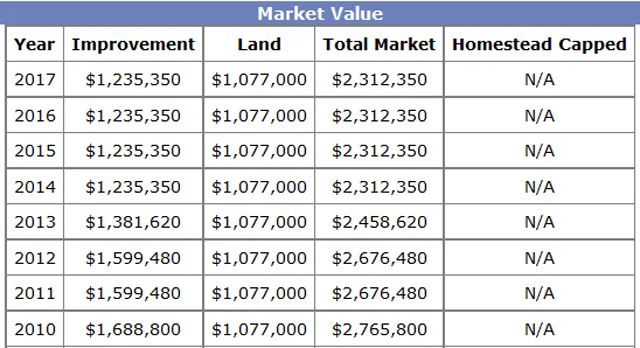

Mayor Rawlings’ Assessed Value Goes Down While the City Goes Up. (Source: DCAD)

Our own Mayor Rawlings, with his estimated $51,000 tax bill, will lose a lot of deductible money. It’s dang lucky his “very good” DCAD rated home has been losing value since 2011. His home is now worth $188,000 less than when it was “effectively” built in 2006 … and $453,000 less since he took office. Don’t “ah-ha,” most of Dallas saw declines in values in 2011/12 as DCAD finally realized a Recession had started two years earlier. But since then? I got nuthin’.

Compare the Mayor’s recent bad luck in real estate to the average Dallas cracker box that increased by as much as a third over the past four years alone. That’s where the double-whammy will be felt. The lower and middle of the housing market and particularly first-timers. Minimizing deductions pushes up monthly costs and may make renting more sensible for longer periods. That has the knock-on effect of diminishing a younger generation’s time as a homeowner and so their ability to pay off a mortgage to turn property into an asset in retirement.

Ditto small-fry second home owners who see costs increase that potentially can’t be passed on to renters. You may be thinking “boo-hoo” on those owning two homes. But a “second home” may not mean two homes. For many, pre-retirement purchasing is the only home they have. Due to several rapid-fire moves where renting was the best option, my pre-retirement home was the only home I owned for 12 of the past 17 years. Since it wasn’t my homestead, it still counted as a second home.

Finally, I would be remiss in pointing out that sub-$435,000 valued homeowners in Dallas with few other deductions MIGHT save a bit taking the standard deduction, provided they’re married. We single-deduction households? Kinda, sorta, not. Our homes would have to be assessed at half the $435,000 of a married couple. Given the growing number of single households, SINKs will be shouldering more than DINKs. (Single/Double Income, No Kids)

Wow, all this and it balloons the debt? No surprise who the winners will be. The Tax Policy Center says, the top 1 percent would get an 8.5 percent boost while the lowest 20 percent get an average 0.4 percent break. Oh, and if you’re one of the 4,918 taxpayers subject to the estate tax, if you hang on for another six years, it’ll be gone.

Of course this ain’t done. The National Association of Realtors and the National Association of Home Builders (big ol’ lobbies) are fighting.